Get paid faster by simplifying billing and payments for attorneys and firm administrators

Firms using LawPay® for Juris® 4 can offer their clients secure, integrated payment options, including credit card, debit card, and eCheck payments with the highest level of PCI compliance. With LawPay for Juris 4, you can now seamlessly integrate on a client or matter level for outstanding invoices, request trust account deposits, and collect payments directly within the LawPay platform.

Experience greater efficiency, productivity, business insights, and ease of use, enabling your firm to better serve your clients.

In Partnership with LawPay:

Schedule a LawPay Demo

* Juris and the Knowledge Burst logo are registered trademarks of RELX Inc.

Optimizing efficiency and simplifying A/R for law firms

For over 30 years, Juris has been helping law firms generate cost savings through more efficient accounting and billing management. LawPay for Juris 4 makes it easy for Juris firms to improve A/R with innovative payment technology that allows you to securely accept credit card and eCheck payments. Trusted by more than 150,000 legal professionals, LawPay has the legal payments expertise you can depend on.

Benefits

Drive faster payments

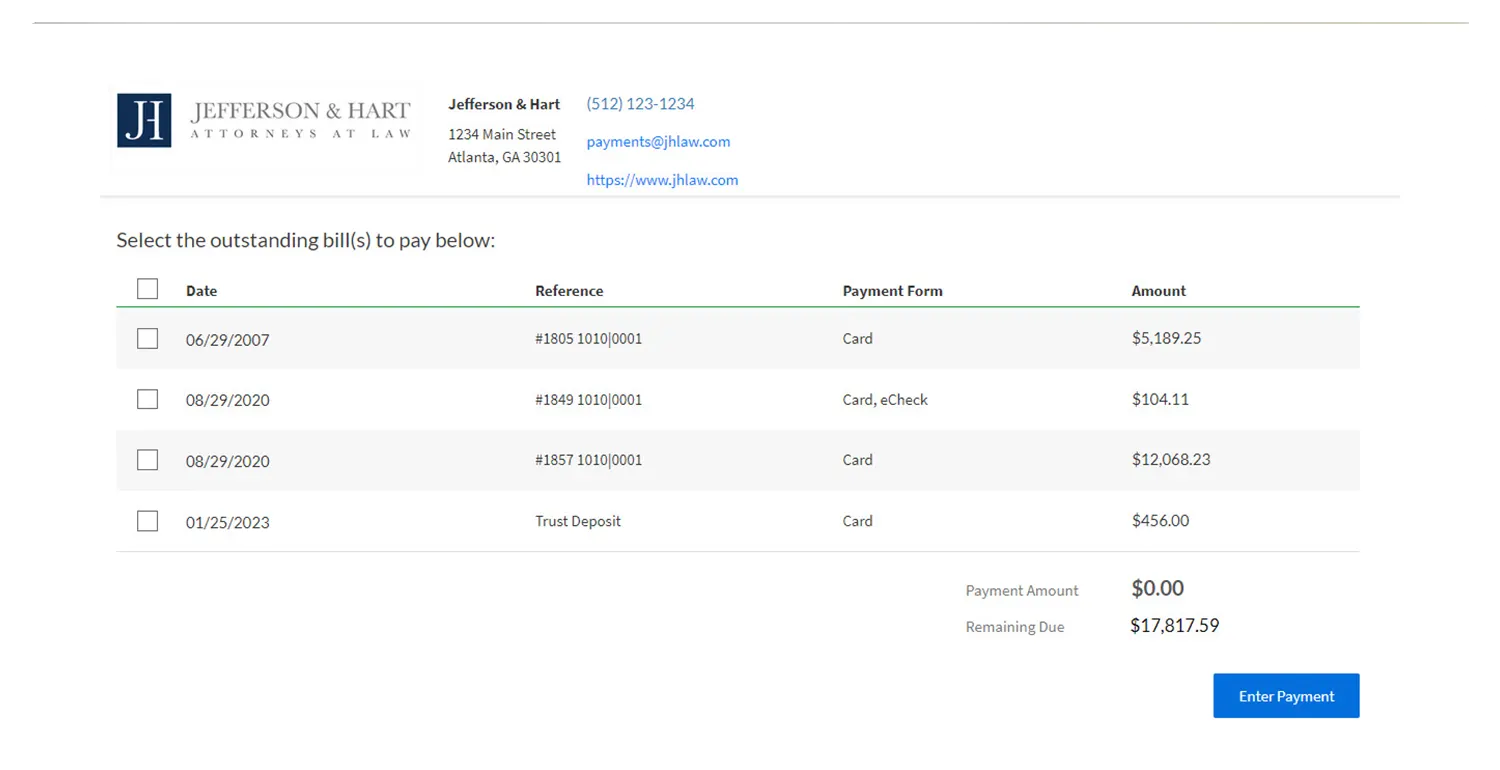

Get paid faster by making it easy for clients to pay. Email invoices and display balances with direct links to secure payment pages.

Streamline the posting of cash receipts

Save time via the LawPay integration sync, ensuring payments are processed to the proper client and matter accounts in Juris.

Complete Reporting for Valuable Insights

LawPay + Juris 4.x reporting was developed to display all deposit details for faster reconciliation, empowering you to organize and analyze payment information in the way that best supports your needs.

Process payments securely

LawPay's secure, end-to-end payment technology immediately encrypts sensitive data to ensure every transaction is protected from start to finish.

How LawPay works for you

Get the most out of LawPay and Juris

Transparent pricing

No setup or cancellation fees

No long-term contracts

Advanced fraud protection and data encryption

Expert in-house support