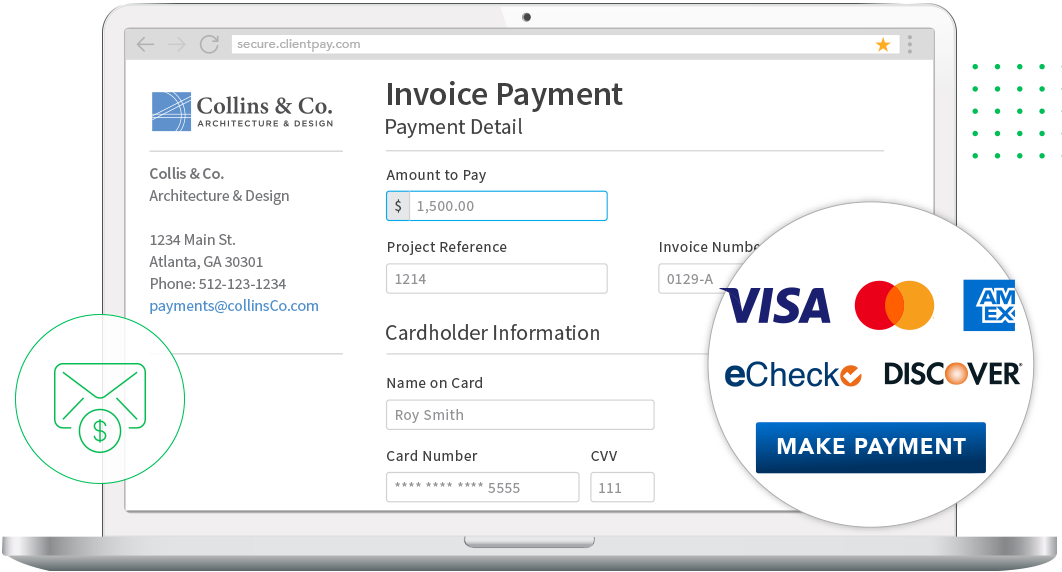

Get paid now, from anywhere

ClientPay is a simple, web-based solution designed specifically for architecture, engineering, design, and construction professionals. ClientPay gives you the power to securely accept credit card and eCheck payments from anywhere—in your office, online, even at a project site. Create a professional payment experience and enjoy a more reliable cash flow by expanding your available payment options and making it easy for clients to pay.

Easily and securely accept credit, debit, and eCheck payments from anywhere and use innovative payment tools to make it easy to get paid.

Rest easy knowing your firm’s data and your client’s sensitive information are protected by advanced data encryption and cybersecurity safeguards.

Not only do we offer straightforward, competitive pricing, but there are also no long-term contracts, no setup fees, and no cancellation penalties.

Our in-house team of Certified Payments Professionals is available via phone, email, or live chat to offer personalized support and expert advice.

GET PAID FASTER

Simplify your payments and grow your revenue

Spend less time chasing unpaid invoices and focus your energy on growing your practice with user-friendly software that makes it easy to get paid. In fact, ClientPay customers experience an average revenue increase of 22% after adopting online payment solutions.

FEATURE SPOTLIGHT

Reporting and reconciliation

Get valuable financial insights with ClientPay’s reporting and reconciliation tools. Our customizable reports and dashboards provide on-demand access to real-time payment statistics and important business metrics. Easily view short- and long-term payment details, including comprehensive daily and monthly transaction summaries as well as deposit history.